Understanding the Benefits of Building Business Credit

Building business credit is essential for establishing a strong financial foundation for your company. A solid business credit profile can help you secure financing, partnerships, and better terms with suppliers. One effective way to boost your business credit is through a business credit builder program.

Benefits

business credit builder accounts are designed to help you establish and improve your business credit score. By using a business credit builder card responsibly, you can demonstrate your ability to manage credit effectively. This, in turn, can lead to access to larger business credit builder loans with favorable terms and lower interest rates.

Many business credit builder companies offer services such as adding BUSINESS CREDIT BUILDER tradelines to your credit report. These tradelines can help boost your credit score by showing a positive payment history and low credit utilization ratio.

How Does it Work?

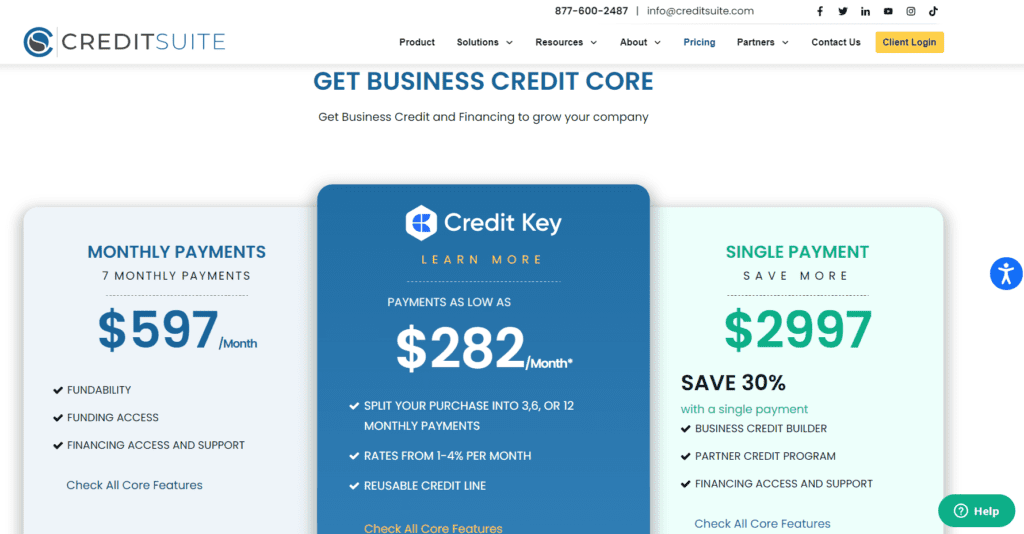

When you enroll in a business credit building program, the company will typically help you open a BUSINESS CREDIT BUILDER card or line of credit. They may also assist you in establishing trade lines with vendors who report to business credit bureaus. By making timely payments and managing your credit responsibly, you can gradually improve your business credit profile.

FAQs

1. What are the key benefits of using business credit building services?

business credit building services can help you establish a strong credit profile for your company, which can lead to better financing options and business opportunities.

2. How long does it take to see improvements in my business credit score?

The timeline for seeing improvements in your business credit score can vary depending on your starting point and how actively you manage your credit.

3. Are BUSINESS CREDIT BUILDER programs suitable for all types of businesses?

While business credit builder programs can benefit most businesses, it’s essential to choose a program that aligns with your specific financial goals and needs.

4. How do business credit builders reviews help in selecting the right program?

Reading business credit builders reviews can provide valuable insights into the experiences of other business owners with different credit building programs. This can help you make an informed decision when choosing a program.

5. Can I build business credit without a business credit builder program?

While it is possible to build business credit without a formal program, using a business credit builder program can streamline the process and provide expert guidance to help you achieve your credit goals more efficiently.

Conclusion

Investing in building your business credit through a reputable business credit builder program can yield significant long-term benefits for your company. By leveraging the services and tools offered by these programs, you can establish a strong credit profile that opens up opportunities for growth and financial success.