Manual data entry. Missed due dates. Lost invoices. These common financial mishaps cost businesses time, money, and trust. If you’re looking to bring accuracy and efficiency to your financial processes, Plooto is the ultimate solution. It automates payments, approvals, and bookkeeping tasks—reducing human errors and giving you full control of your cash flow.

Why Accuracy Matters — And How Plooto Delivers It

Even a single typo in a bank account number or invoice can delay payments and hurt business relationships. With Plooto, such risks are minimized. The platform uses smart automation and real-time validation to ensure every transaction is accurate, secure, and audit-ready.

Key Features of Plooto That Minimize Mistakes

🧠 Intelligent Invoice Capture

Plooto uses OCR (optical character recognition) technology to extract invoice data automatically. This eliminates manual input errors and ensures correct amounts, due dates, and vendor information every time.

🔁 Two-Way Accounting Integration

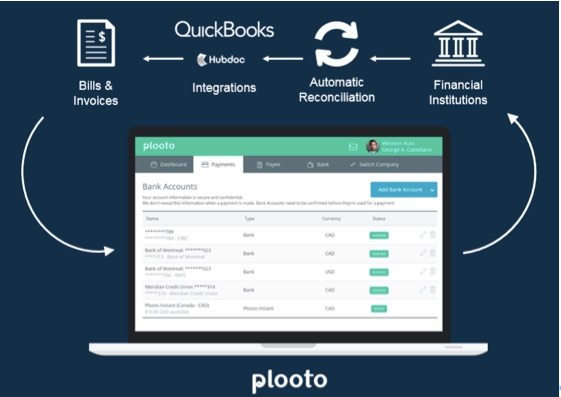

With seamless syncing to platforms like QuickBooks, Xero, and NetSuite, Plooto prevents duplicate entries and keeps your books accurate with real-time updates.

🔐 Multi-Layer Approval Workflows

Plooto allows businesses to implement multi-user approval processes. This adds a layer of validation before any payment goes out—drastically reducing costly mistakes.

🕵️ Real-Time Tracking and Alerts

Know the status of every payment. Plooto notifies you of errors, delays, or missing information—so you can take action before small issues become big problems.

Business Impact of Using Plooto

- Fewer errors mean fewer chargebacks, rejections, or vendor issues

- Improved financial data accuracy leads to better decisions

- Automated workflows reduce dependency on manual labor

- Faster reconciliation improves monthly close times

Who Should Use Plooto?

Plooto is perfect for:

- Finance teams aiming to reduce manual entry

- Small businesses with limited accounting staff

- Bookkeepers looking for reliable automation

- Companies experiencing frequent invoice or payment errors

Final Thoughts

In a fast-paced business environment, accuracy is everything. Plooto helps you avoid mistakes, reduce risks, and operate with confidence. By automating your payment systems and integrating your financial tools, you gain better control over your finances—without the stress.

Make the switch to Plooto and eliminate costly errors once and for all.